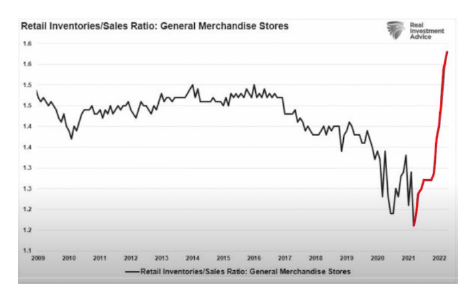

With such uncertainties in lead time, many retailers and online sellers piled up inventory in anticipation of continued demand from government cash handouts and stimulus leading to asset price inflation. As a result, even if consumer demand is forecasted to decline, shipments will still be in route and orders under production. This mismatch in supply and demand will cause retailers to slash prices to clear excess inventory, as indicated by Target earlier this month that its profits would drop as it canceled orders and offered discounts.