You're missing out if you’re an Amazon seller and are not yet familiar with Amazon’s Product Opportunity Explorer. It’s a great tool for finding product niches, search terms, advertising targets, and even product development insights. Below are the first of three actionable ways to use data in the Product Opportunity Explorer.

Identify and Research Potential Niches

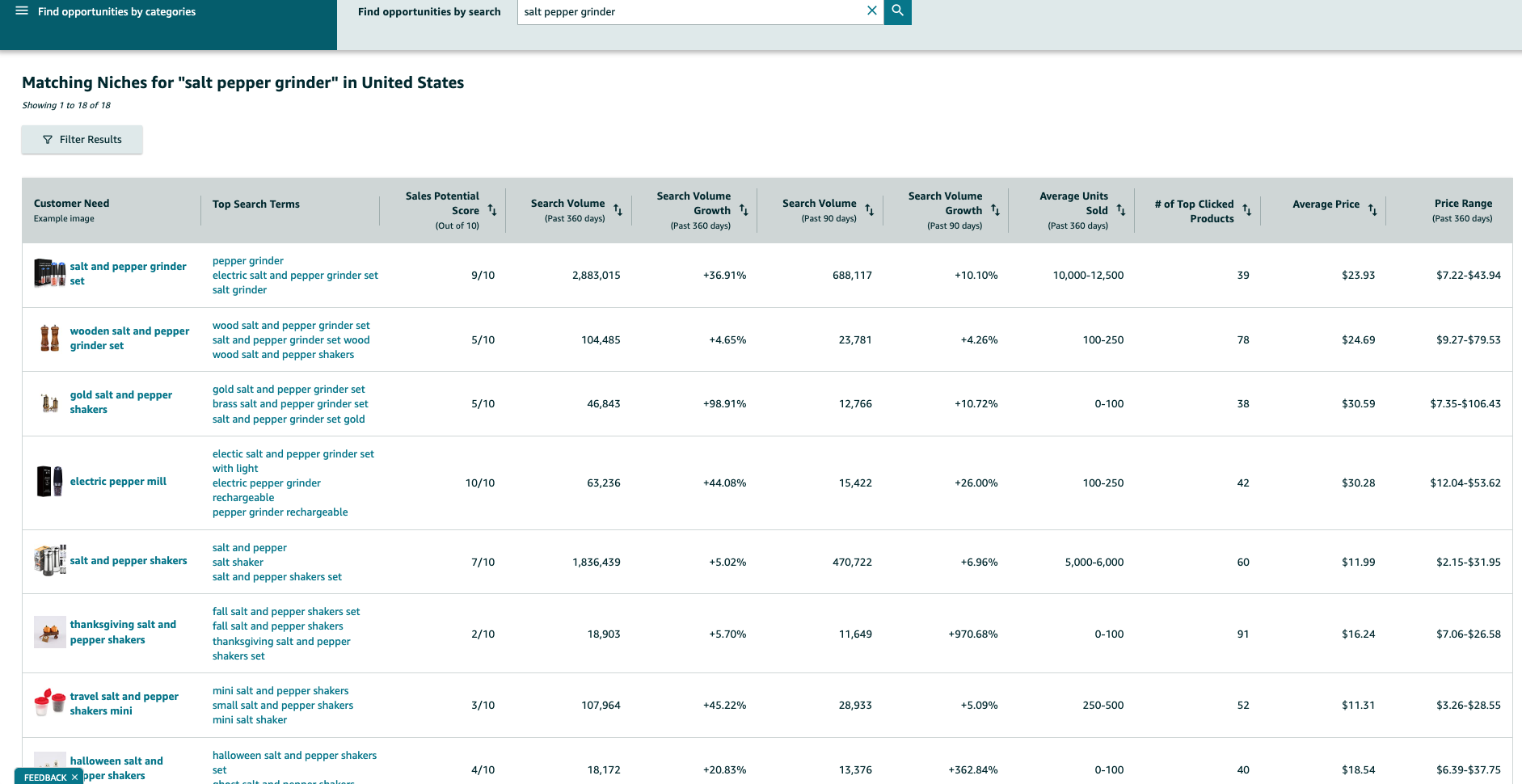

Amazon refers to new product ideas as niches, so keep this in mind, as I will refer to niches often when talking about this tool. To start, you’ll need to enter a search term that relates to the niche you are interested in. Once you enter the search term, a list of relevant niches will populate In my example, I will use the search term “salt pepper grinder.”

In the list of niches, you’ll find useful data fields to give you a better idea about the niche's sales volume, trend, average price, and distribution of clicked products. Looking at the data, the salt and pepper grinder set looks best to me because of the strong search volume and growth (consumer demand) with a price range I feel I can be competitive in, so I’ll proceed with the niche, “salt and pepper grinder set.”

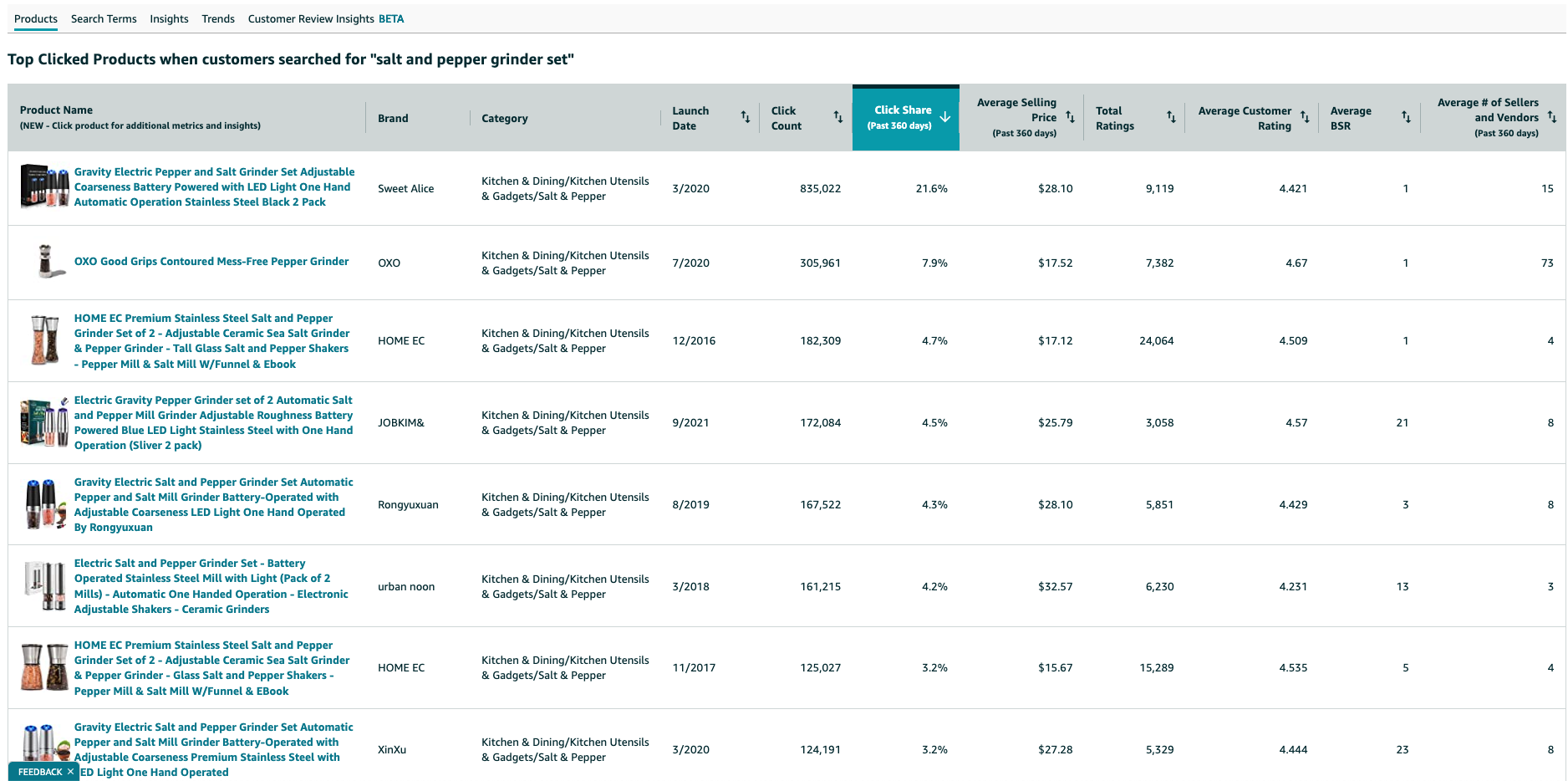

The first tab of five will direct you to see the Products tab. This is a list of top clicked-on products for this niche, accompanied by data that will give you insights about what drives CTR (click-through rate) and if clicks are concentrated.

What Drives CTR

You can conclude what drives CTR for this product niche by referring Click Share to Average Selling Price, Total Ratings, and Average Customer Ratings.

Looking at the electrified salt pepper grinder sets data, I can conclude reviews are a large part of what drives CTR. The top clicked-through item has the lion's share of CTR (21.6%) in this product niche, and it has almost twice as many reviews compared to the runner-up item (9,119 vs. 5,851). With the price range of the products relatively equal at about a 10% deviation ($28.1 vs. $25.79), I can conclude shoppers prefer to go with a highly reviewed item, even if there are comparable products that are 10% cheaper.

CTR Concentration

Checking the concentration of CTR around top-rated BSR products will indicate how distributed sales are in this niche. The more distributed the sales are, the easier (cheaper) it is to enter this niche, and vice versa. Looking at the data, the top-ranked products get most of the click-through, and the runner-ups tend only to get 3-4% (Top #1s- 21.6%/7.9%/4.7%; Next 3- 4.5%/4.3%/4.2%). This indicates that this is a winner takes all category, and I need to plan to rank my product top row on page 1 or expect to have suboptimal CTR and sales.

Next, let’s look at the Insights tab.

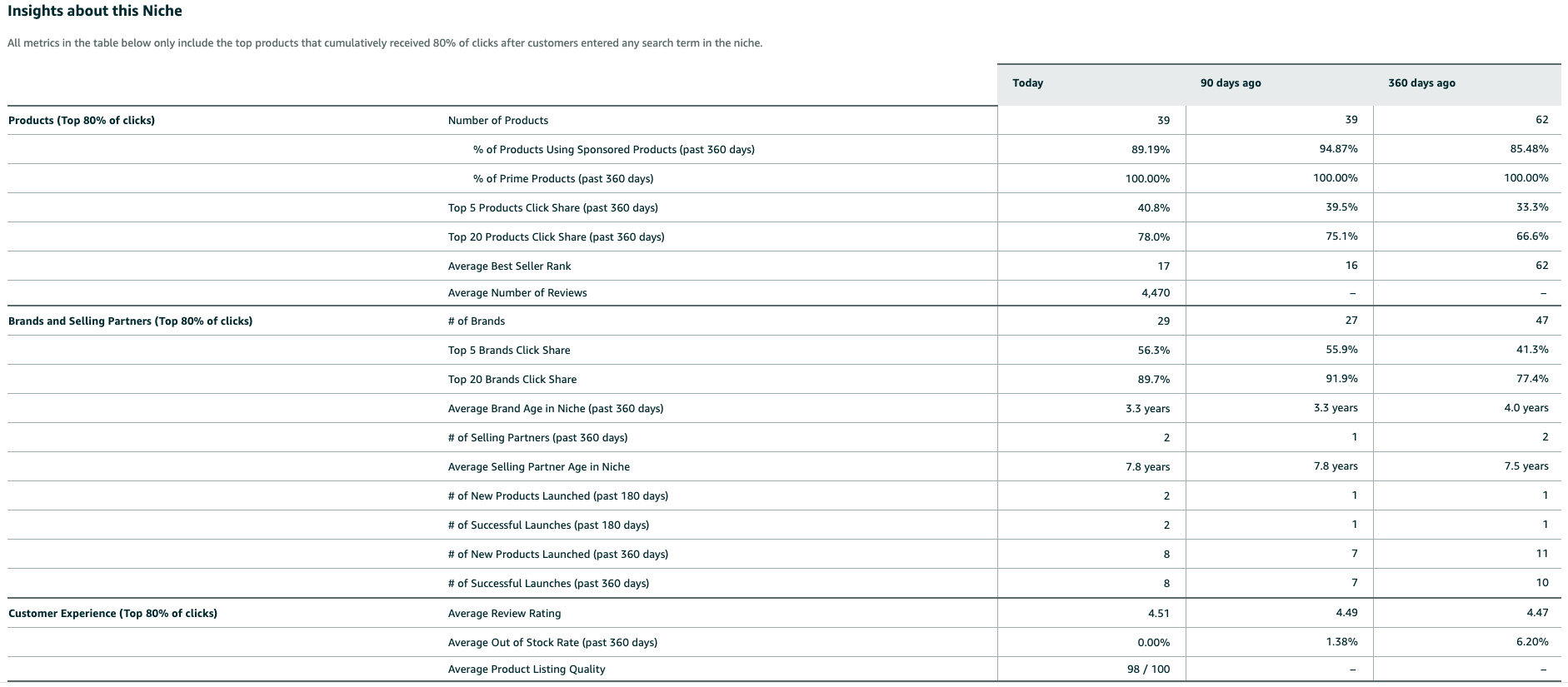

Here you’ll see more data that indicates product success rate, position/brand dominance, and listing quality.

Product Success Rate

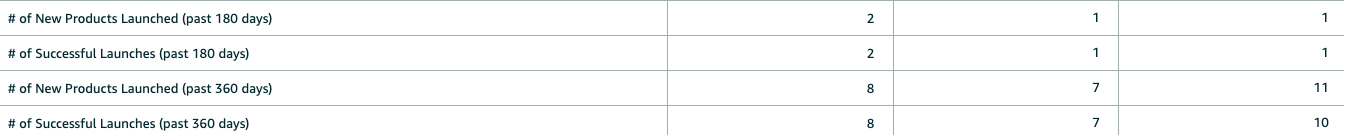

Looking at the # of New Products Launched vs. # of Successful Launches numbers, you may think that’s weird, and I thought this category would be difficult to get into. I must admit, this is a bit deceiving on Amazon’s part. Note the top line on the page, “All metrics in the table below only include the top products that cumulatively received 80% of clicks after customers entered any search term in the niche.”

This means the numbers shown above do not include the new product launches that did not get within the 80% of clicks on Amazon. You can assume those sharing the 20% of CTR is a long list of products where most are now in the Amazon graveyard. RIP. Nevertheless, there is a takeaway from the Product Success Rate. If you can get your new product within the top 80% of CTR, you can expect $4,000 in sales per (Amazon’s metric of success).

Position/Brand Dominance

Similar to the CTR concentration, this metric tells us on an overview level how concentrated the clicks share for the Top 5 Products and Top 5 Brands is. In our example, we have 40.8% for position and 56.3% for Brands. This tells me that many shoppers are looking for high-ranked and trusted products, and even more are shopping on brands. Ideally, I prefer to have both figures under 50%, where the lower, the better.

Listing Quality

The Customer Experience section and Average Number of Reviews figure tell me how formidable the existing product listings are from current sellers. The higher the average number of reviews, average review rating, and average listing quality, the more difficult it is for me to compete in this niche. At 4,470 average reviews, 4.51/5 average review rating, and 98/100 listing quality, I can conclude this niche is highly competitive with established listings.

This concludes the first ways to use Amazon’s Product Opportunity Explorer in identifying and Researching potential niches. Next, we’ll discuss ways to use Product Opportunity Explore to add search terms and product targets to your advertising and customer review insights to develop products.

Click here for part two of this article